CALIFORNIA CATTLE RANCHER SHARES ONE BIG BEAUTIFUL BILL INSIGHTS AT CONGRESSIONAL HEARING

For Immediate Release: July 26, 2025

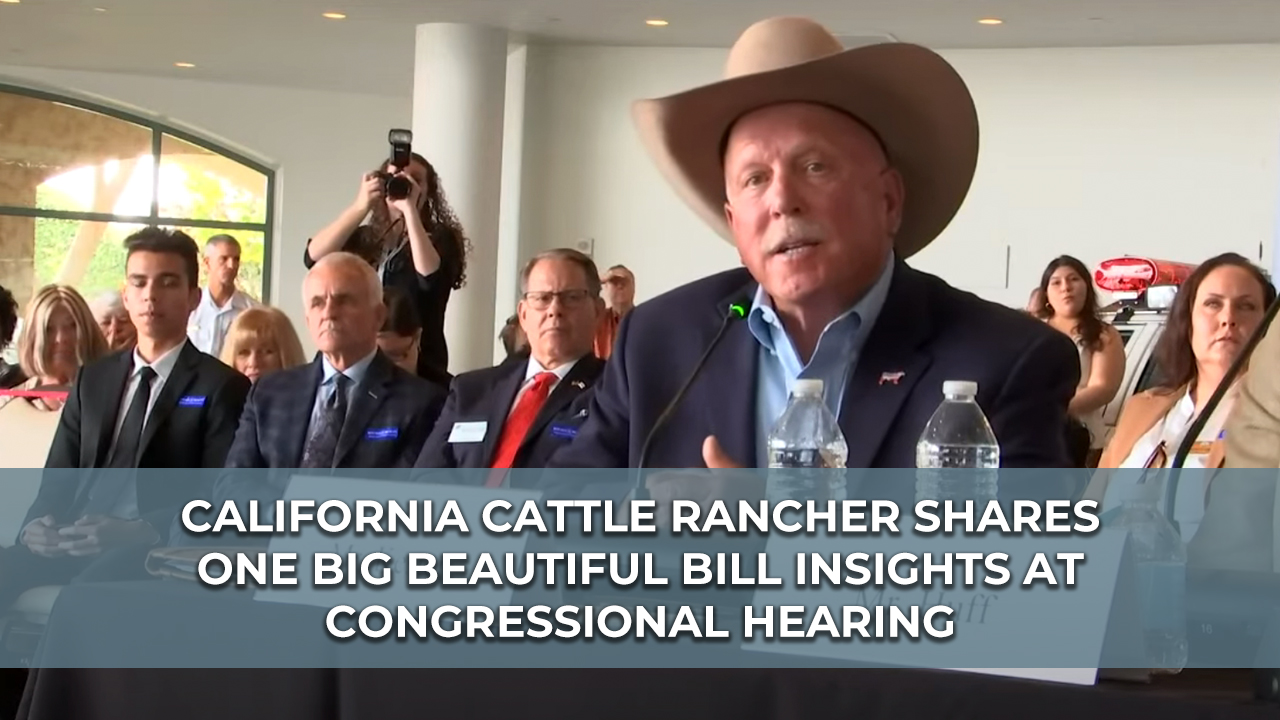

WASHINGTON — Today, California Cattlemen’s Association (CCA) and National Cattlemen’s Beef Association (NCBA) member and California rancher Kevin Kester testified at a House Ways and Means Committee field hearing in Simi Valley at the Ronald Reagan Presidential Library on the implementation of the One Big Beautiful Bill. The One Big Beautiful Bill contains numerous wins for cattle farmers and ranchers, thanks to the tireless advocacy of NCBA.

“As a fifth-generation rancher, I feel blessed to raise cattle alongside my wife, children, and grandchildren. I want to see this way of life continue for future generations, which is why it was so important for Congress to pass the One Big Beautiful Bill,” said Kester. “I know what it’s like to see your farm or ranch burdened by a massive tax bill, and the One Big Beautiful Bill delivers the tax relief we need to save money, grow our operations, and make sure our children and grandchildren can make a living in the cattle business. I’m proud to deliver this message to Congress and appreciate the opportunity to highlight NCBA’s work to protect the cattle industry.”

Over a year ago, NCBA recognized the risk of a massive tax hike on the cattle industry if Congress failed to enact new tax legislation by the end of 2025. NCBA went to work meeting with policymakers, testifying at congressional hearings, and submitting tax comments to make sure that Congress protected family farmers and ranchers from higher taxes. Thanks to NCBA’s hard work, the One Big Beautiful Bill contains numerous pro-agriculture tax provisions, including:

- Increasing the Death Tax exemption to $15 million per individual or $30 million per couple, adjusted annually for inflation. As land values skyrocket and farms appear to be worth more on paper, increasing the Death Tax exemption protects cattle producers from an additional tax burden when passing their operation on to the next generation. The bill also protects Stepped-Up Basis which helps producers minimize their Death Tax liability.

- Making the Section 199A Small Business tax deduction permanent, allowing family farms and ranches to deduct 20% of their business income, keeping more of their hard earned money.

- Increasing the Section 179 deduction to allow farmers and ranchers to deduct business expenses like equipment purchases up to $2.5 million.

- Making 100% bonus depreciation permanent so farmers and ranchers can deduct the full cost of capital investments like equipment when they purchase them, rather than taking small deductions over several years.

- Extending itemized deductions for losses incurred due to federally declared disasters.

Additionally, the One Big Beautiful Bill includes several key Farm Bill provisions important to cattle producers like expanding the Livestock Forage Disaster Program, funding the Livestock Indemnity Program, supporting voluntary conservation tools, and bolstering foreign animal disease protections.

Importantly, the final version of the One Big Beautiful Bill that was signed into law by President Trump did not include any of the controversial public land sale or eminent domain provisions that previously attracted media attention.

“Stories like Kevin Kester’s are why NCBA fought so hard to get the One Big Beautiful Bill signed into law and protect family farms and ranches from massive tax hikes,” said NCBA President Buck Wehrbein. “The One Big Beautiful Bill will help family cattle operations of all sizes save more of their hard earned money. The Farm Bill provisions in the law will also help protect the cattle industry from a foreign animal disease outbreak, help producers recover from depredation and drought, and offer more resources for voluntary conservation. NCBA thanks Congress for passing this bill and President Trump for signing it into law. This is the type of victory that will strengthen the cattle industry for years to come.”

“The One, Big Beautiful Bill gets a lot right for agriculture. Like many U.S. cattle ranchers, I’m excited about what it delivers and believe we need to keep sharing why these wins are critical to America’s economy and future,” said Rick Roberti, Northern California rancher and president of the California Cattlemen’s Association. “That’s why I greatly appreciate Chairman Jason Smith and the House Ways and Means Committee for hosting this field hearing and giving us the chance to highlight the economic benefits tied to agriculture. Having California cattle rancher Kevin Kester testify and share his story was a powerful way to show how these wins will directly support farming and ranching families across the nation for generations to come—from critical tax provisions (including the death tax exemption) and key Farm Bill programs to major investments in animal health.”

###

The California Cattlemen’s Association is a non-profit trade association representing California’s ranchers and beef producers in legislative and regulatory affairs.

The National Cattlemen’s Beef Association (NCBA) has represented America’s cattle producers since 1898, preserving the heritage and strength of the industry through education and public policy. As the largest association of cattle producers, NCBA works to create new markets and increase demand for beef. Efforts are made possible through membership contributions. To join, contact NCBA at 1-866-BEEF-USA or membership@beef.org.