USDA Begins Accepting CFAP Applications Today

Beginning today, the US Department of Agriculture (USDA) will begin accepting applications for economic relief payments under the Coronavirus Food Assistance Program (CFAP) via USDA’s Farm Service Agency (FSA) offices. CFAP will provide $16 billion in direct economic relief payments to farmers and ranchers suffering the market impacts of the COVID-19 pandemic, with $5.1 billion of that relief earmarked for beef producers.

How to Apply for CFAP

FSA begins taking CFAP applications today. At this time, USDA Service Centers are open for business by phone appointment only, so ranchers should call their county FSA office to schedule an appointment. You can find contact information for your county FSA office here (click on the Northern or Southern region and then click on your county to find your county office’s contact information).

USDA has posted a video guide to the application process here. First, producers will need to complete a CFAP Application (form AD-3114). USDA has released a CFAP Payment Calculator as an Excel workbook which can be used to complete the form AD-3114, at www.farmers.gov/CFAP (under the “CFAP Application” heading).

Applicants may need to complete additional paperwork to report information such as tax identification number, the operating structure of your ranch, adjusted gross income (to ensure eligibility) and direct deposit information. Those forms are also available at www.farmers.gov/CFAP.

CFAP applications and supporting materials can be submitted electronically by scanning, emailing or faxing them to your FSA office. USDA has asked that you call and make arrangements with your county FSA office prior to submitting applications electronically. USDA has established a CFAP Call Center for producers who would like additional one-on-one support with the CFAP application process, at (877) 508-8364.

CFAP applications will be accepted now through August 28, but CCA recommends that ranchers apply for relief payments without delay.

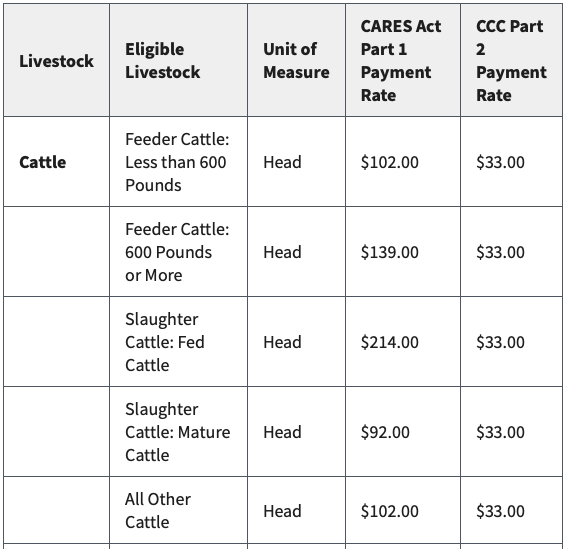

Eligible Livestock and Payment Rates

CFAP assistance is available to livestock producers who have an ownership interest in eligible livestock that have suffered a five percent-or-greater price decline as a result of the COVID-19 pandemic and face additional significant costs in marketing their inventories due to unexpected surplus and disrupted markets. A single payment for livestock will be calculated using the sum of two calculations: (1) the producer’s number of livestock sold between January 15 and April 15, 2020 multiplied by the payment rates per head (below), and (2) the highest inventory number of livestock between April 16 and May 14, 2020, multiplied by the payment rate per head (below). Note: Those who sold no cattle between January 15 and April 15 are still eligible for relief payments under the second calculation but will receive no reimbursement under the first calculation.

Definitions for each category of eligible livestock—and other details regarding CFAP—can be found in the National Cattlemen’s Beef Association’s CFAP Background and Frequent Asked Questions document, here.

After reviewing the CFAP, CCA believes that payments under Part 2 of the program fall short of providing full, meaningful relief for California ranchers hard-hit by the economic fallout of COVID-19. CCA is working with our national affiliate the National Cattlemen’s Beef Association (NCBA) to provide additional relief for America’s ranchers. As previously reported in Legislative Bulletin, there are already bipartisan efforts in Congress to infuse the program with funding to provide additional relief to farmers and rancher.

Eligibility

A person or legal entity, other than a joint venture or general partnership, is ineligible for payments if the person or legal entity’s average adjusted gross income (AGI) between tax years 2016-2018 is more than $900,000, unless at least 75 percent of that person or legal entity’s average AGI is derived from farming, ranching or forestry-related activities. The AGI cap is waived for individuals who can certify that 75% or greater of their income is derived from agricultural production.

Payment Limits

CFAP payments are subject to a per-person and legal entity payment limitation of $250,000. This limitation applies to the total amount of CFAP payments made with respect to all eligible commodities. The total payment amount of CFAP payments attributed to an individual will be determined by accounting for the direct and indirect ownership interests of the individual in all legal entities participating in CFAP.

Unlike other FSA-administered programs, special payment limitation rules will be applied to participants that are corporations, limited liability companies and limited partnerships (corporate entities). These corporate entities may receive up to $750,000 based upon the number of shareholders (not to exceed three shareholders) who are contributing substantial labor or management with respect to the operation of the corporate entity.

Payment Disbursement

According to USDA, initial CFAP payments will be distributed “shortly after the application is approved by FSA,” likely within 7-10 days. Initial payments will only cover 80% of an applicant’s calculated CFAP total. To ensure that CFAP payments do not exceed the $16 billion funding limit, the remaining 20% of a producer’s payment “will be paid at a later date as funds remain available.”

RECENT COVID-19 UPDATES

USDA Announces Resumption of CFAP Payments

USDA will resume issuing payments under CFAP early next month.

Legislative Bulletin: January 25, 2021

CCA's latest weekly e-newsletter is here.

Congressional COVID Relief Compromise, Omnibus Spending Package Includes CFAP Payments Among Other Provisions for Ranchers

Details for ranchers on the House's newly proposed funding package.